NO LIMITS TO

YOUR VERIFICATION POWER

Book a demo today and see the DecisionLogic difference in your business!

Welcome To DecisionLogic

Our service provides the ability to verify a borrower’s identity, bank account number and balance in real-time. It also provides access to up to 365-days of borrowers’ bank account transaction history with a layer of advanced analytics that lead the industry. This automated real-time process empowers you to make fast and accurate decisions critical to the success of your business.

Years of Continued Service

0

Financial Institutions Supported Globally

0

+

% System Uptime

0

.95

Consumers Served

0

+

Recent Announcements

New Data Points! Gain real-time visibility into available cash and spending habits!

Avoid Risky Business with the First Payment Default Score!

DecisionLogic celebrates 100 million consumer served!

Streamline Your Borrower Workflow with DecisionLogic’s New Bank Change Notification!

Solutions for Top Industries where Real-Time Assessment of Transaction History is Critical

Join the wave of business owners verifying their applicants with the click of a button.

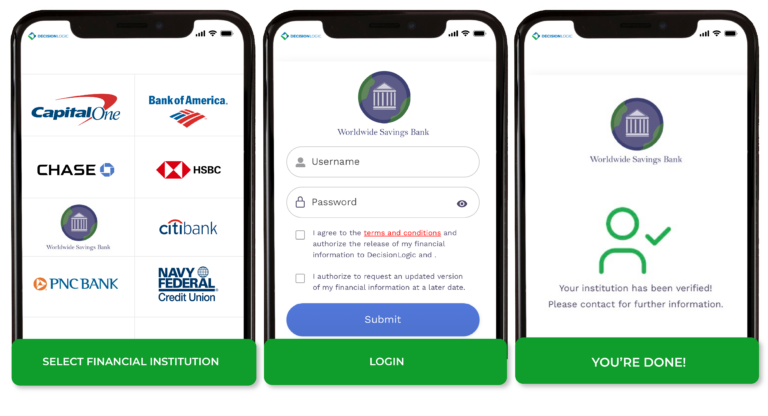

Applicant view

Lender view

Integrate With Us Today

Our Partners Say

“Your dependable solutions have not only streamlined our processes but also enhanced our capability to serve our customers with heightened efficiency and innovation.”

– LendSaas

“At Answers Etc., technology, function, and innovation are our drive and focus every day. Our valued and continued partnership with DecisionLogic provides advantages for our lending clients by creating greater efficiencies with IAV solutions.”

– Answers Etc.

“We at UPAY have benefited immensely by using the services of DecisionLogic. Their Bank Statement Aggregation product is second-to-none! The data insights of their product have helped our clients make clear decisions on credit granting. DecisionLogic’s innovative solution has revolutionized the way our clients assess creditworthiness, allowing us to provide our clients with accurate and actionable information. Their commitment to excellence and dedication to helping us achieve our vetting goals have made them an invaluable partner in our journey.

We highly recommend DecisionLogic to anyone in the financial industry looking to enhance their credit assessment processes.

Thank you, DecisionLogic, for your exceptional product and unwavering support!”

– Upay Technology

“Our Strategic Partners are immensely important because we trust them with our customers. DecisionLogic always exceeds expectations with fast and professional responses and an exemplary customer service.”

– OnyxIQ

“The ease and speed of integration, combined with the excellent technical support from our partner, DecisionLogic, has enabled us to deliver high-quality services to our shared clients.”

– QFund

“DigiFi is delighted to have partnered with DecisionLogic. Their ability to harness the predictive power of banking data is impressive. The broad range of banks accessible through DecisionLogic’s platform, coupled with their use of advanced analytics, provides DigiFi’s clients with a granular view on a very large portion of U.S. borrowers. DecisionLogic’s flexible product set fits well with DigiFi’s highly configurable digital lending platform, allowing us to address a wide range of lending use cases together.”

– DigiFi